Key Takeaways:

- When you borrow a loan against your mutual funds you get instant access to cash without liquidating your investments.

- A loan against mutual funds has no immediate tax consequences compared to asset selling where you will pay for capital gains.

- It has flexible repayment options with an interest rate applicable only to the amount used.

- You can secure mutual fund loans within minutes and have the amount disbursed to your bank account on the same day.

Loans like personal loans, home loans, or gold loans are common phrases that almost every household is aware of.

But what are loans against mutual funds?

This new type of loan, is it even meant for you in the first place?

And if it is, how exactly can you benefit personally from it?

In this detailed guide, we’ll talk about it all.

The Concept Of Borrowing Loan Against Mutual Funds

Every financial requirement could be fulfilled by the availability of cash.

Now even though personal loans and other types of loans have been around for a while, they are also such options that may require multiple days’ worth of documentation and anticipation for approval.

Loans against mutual funds, however, are different.

A loan against mutual funds can help you source immediate funding without liquidating your investments.

Borrowing against mutual fund assets means using your investments as collateral, assuring the lender that the loan balance will be repaid.

This strategic financial facility allows you to borrow a principle equivalent to your asset value.

For equity mutual funds, you can borrow up to 50% of your portfolio value.

And for debt mutual funds, you can borrow up to 80% of your portfolio value.

And the best part? Your profit return remains untouched.

And not to forget, mutual fund loans have lower interest rates and flexible repayment schedules. This makes them one of the most preferable loan options.

Key Considerations When You Pledge Mutual Funds For A Loan

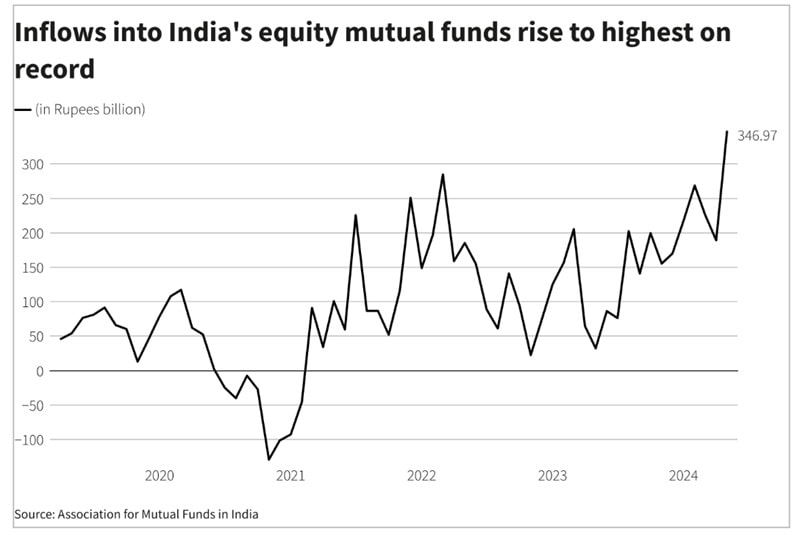

In May 2024, the Indian mutual fund market reached an unprecedented $701.90 billion.

But you don’t opt for a loan just because of its popularity.

Loans are serious business so understanding their working is as important as how you can leverage from them.

Interest rate, payment schedule, approval rate, and eligibility criteria are some of the most important aspects of this model that you should consider before applying for credit.

Let’s explore the key considerations of mutual fund loans so you can clearly visualize how they can help your situation.

Asset Value As Loan Limit

The total amount of loan you can avail, is determined by the current value of your mutual fund investments.

This means the lender processes the market value of your mutual fund holdings, the one you use as collateral, arriving at a percentage to calculate the total loan amount you can draw.

This is called the Loan-to-Value Ratio.

The loan-to-value ratio or LTV ratio compares the interest and principal amount to your appraised collateral value (your mutual fund units).

Overdraft Facility

The overdraft facility gives mutual fund loans an edge over traditional loans from banks, as you can withdraw as much money as you require, as long as it’s under the sanctioned limit.

Additionally, you also only pay interest on the amount you’ve used.

Flexible Repayment

Making them an ideal option, loans against mutual funds are less risky and flexible.

You can repay the loan according to your feasibility, ensuring they align with your lender’s requirements.

Also, there’s no urgent need to worry about penalties or long-term debts as the option is highly convenient and manageable.

Loan Against Mutual Funds – A Pragmatic Solution

Borrowing against mutual funds can help you secure immediate financing without abandoning long-term investment strategies, establishing it as a practical solution.

Here are some of the most important benefits of mutual fund loans:

1. A Better Alternative To Personal And Credit Card Loans

While personal loans and credit cards are good loan options too, they generally offer higher interest rates.

A loan against mutual funds is a better alternative, allowing you to preserve your investments and benefit from several tax advantages.

With interest rates as low as 10.5%, it offers a higher loan limit and long-term security.

2. Aligns Short-Term Needs With Long-Term Plans

Investors consider it a viable solution as it allows them to procure funds to meet urgent financial needs without liquidating their investments or forfeiting potential gains.

This way, they can benefit from possible market growth and dividends, a sum that can increase over time.

This solution is also tax efficient because when you sell your assets, you’re liable to pay capital gains. On the other hand, there aren’t any tax consequences when you opt for mutual fund loans.

3. Quick Disbursal

Loans against mutual funds are approved within minutes as the entire process is digitalized.

One of the best features of mutual fund loans is that you also get quick approval and disbursal times.

At 50Fin, you can very well get approval on your mutual fund loan application in just 7 minutes.

4. No Prepayment Charges

No matter if your mutual fund loan is expanded into a tenure of 12 months or you want to shrink it to foreclosing it in just a month, there are no extra charges.

There are no prepayment charges as well.

You can repay your loan as early as you like bearing no additional charges.

5. Fully Digitalized Process

Since you’re borrowing against your mutual fund portfolio, your mutual fund units are used as collateral.

This means that the entire borrowing process is digital – right from the application to the disbursement.

Instead of waiting in line for hours to convince lenders, you can now secure a loan against a mutual fund comfortably while sitting at home.

It takes a few minutes and has minimal documentation.

6. Continue Gaining Profit on Mutual Funds

So what about ownership, you may wonder.

Well, you still have ownership of your mutual fund units which means you continue to gain profit despite having taken a loan against them.

This makes it a brilliant financial move – one that effectively meets financial shortcomings without disrupting long-term goals.

Checklist To Determine Eligibility For Loans Backed By Mutual Funds

Here’s your checklist to determine your eligibility for getting a loan against mutual funds:

- The age limit for this loan is between 18 and 65 years.

- You also need a minimum portfolio value, typically at least ₹50,000.

- Stable equity funds are preferred more than volatile ones.

- While you should be a primary owner of mutual fund units, joint owners can also apply by providing each party’s signature.

- You should be KYC-compliant. For this, you require government-issued IDs or utility bills.

If You’ve Decided To Get A Loan Against Mutual Funds, Here’s What You Need To Do…

- Make sure you’re eligible for the loan.

- Find a lender who has a good financial history and has efficient customer support.

- Visit the mutual fund loan platform (or download the app) to start the loan borrowing process.

- Start the application process.

- Pledge your mutual fund units and sign the e-agreement.

- Within a few minutes, you’ll receive the approval notification and within the same day, the loan amount will be disbursed to your bank account.

Now all you have to do is adhere to the repayment schedule and monitor your mutual fund value.

The Bottom Line

Getting a loan against a mutual fund is a smart financial strategy that safeguards your long-term goals while meeting temporary financial shortcomings.

Offering several benefits, like flexible repayment schedules, higher loan limits, and lower interest rates, a loan against mutual funds is a pragmatic solution for investors.

This capital acquisition allows you to accumulate long-term wealth and leverage wider investment opportunities.

Given this holistic view, a loan against mutual funds always seems like one of the best personal loan options available.

Meet Suhas Harshe, a financial advisor committed to assisting people and businesses in confidently understanding and managing the complexities of the financial world. Suhas has shared his knowledge on various topics like business, investment strategies, optimizing taxes, and promoting financial well-being through articles in InvestmentDose.com