The Bitcoin DeFi landscape has experienced significant growth, with several innovative applications emerging to enhance Bitcoin’s functionality beyond its traditional role as a store of value. These platforms leverage Bitcoin’s security and liquidity to offer various financial services, from smart contracts to decentralized exchanges.

In this post, we look at six Bitcoin DeFi applications that are making waves and are worth checking out. Checking out these dApps is a good place to start if you want to learn how to earn a yield on BTC and what the future of DeFi on the Bitcoin network is likely to look like.

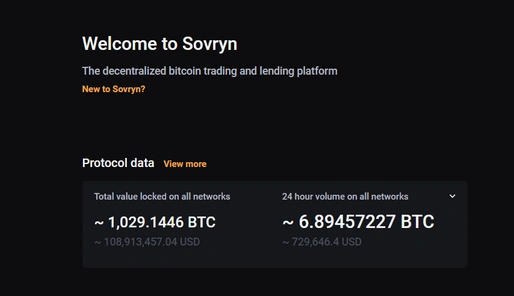

Sovryn

Sovryn is a decentralized finance (DeFi) protocol built natively on the Bitcoin blockchain through the Rootstock (RSK) sidechain. It offers a comprehensive suite of financial services within the Bitcoin ecosystem. Launched in 2020, Sovryn provides tools for trading, lending, borrowing, and yield generation, enabling bitcoin holders to interact with DeFi while maintaining sovereignty over their funds.

With features like a decentralized exchange (DEX), margin trading, lending pools, and liquidity provision, Sovryn empowers users to earn yield, trade with leverage, and access permissionless financial services directly from their Bitcoin wallets. By leveraging Bitcoin as the settlement layer and Rootstock for smart contract capabilities, Sovryn combines the decentralization and security of Bitcoin with the flexibility of DeFi.

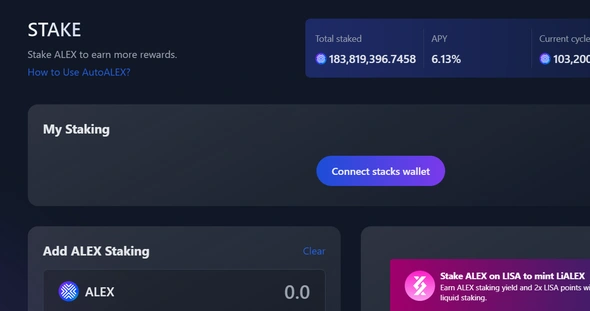

ALEX

ALEX (Automated Liquidity Exchange) is an open-source DeFi protocol built on the Stacks blockchain, aiming to replicate and enhance traditional financial markets within the Bitcoin ecosystem. Launched on mainnet in January 2022, ALEX offers a suite of services, including a decentralized exchange (DEX), lending and borrowing platforms, staking, yield farming, and a launchpad for emerging token projects.

By utilizing Bitcoin as the settlement layer and Stacks for smart contracts, ALEX provides users with a seamless experience to trade assets, earn interest, and participate in new project launches, all while benefiting from Bitcoin’s security and liquidity.

Arkadiko

Arkadiko is an open-source DeFi protocol built on the Stacks blockchain. It was launched in 2021 and is designed to enhance financial utility within the Bitcoin ecosystem. Through its native USDA token, Arkadiko offers various services, including collateralized lending, automated market-making (AMM), and stablecoin minting.

By allowing users to lock Stacks (STX) tokens as collateral, Arkadiko enables the minting of USDA, a bitcoin-secured stablecoin, providing liquidity without requiring users to sell their assets. The protocol also facilitates yield generation through liquidity pools, allowing users to earn rewards while participating in a decentralized financial ecosystem.

Leveraging Bitcoin as the settlement layer and Stacks for smart contract functionality, Arkadiko empowers users with seamless access to decentralized lending, liquidity provision, and stablecoin-based transactions. These services are underpinned by Bitcoin’s security and decentralization principles.

Liquidium

Liquidium is a DeFi platform that provides liquidity solutions within the Bitcoin ecosystem. By offering services such as liquidity pools and decentralized lending, Liquidium enables users to earn yields on their Bitcoin assets and access capital without the need for traditional intermediaries.

This approach increases the efficiency of capital within the Bitcoin network and fosters a more inclusive financial system by lowering barriers to entry for users worldwide.

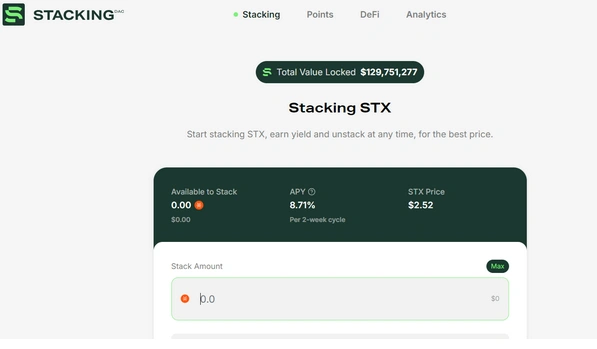

Stacking DAO

Stacking DAO is a liquid stacking protocol on the Stacks blockchain that simplifies the process of earning yield on bitcoin holdings. By allowing users to stack their STX tokens through the protocol, they can earn native bitcoin yield without the complexities associated with traditional stacking methods.

Stacking DAO has gained significant traction, surpassing $100 million in total value locked within a few months of its launch. This highlights its effectiveness in providing liquidity to stackers while supporting the Stacks network.

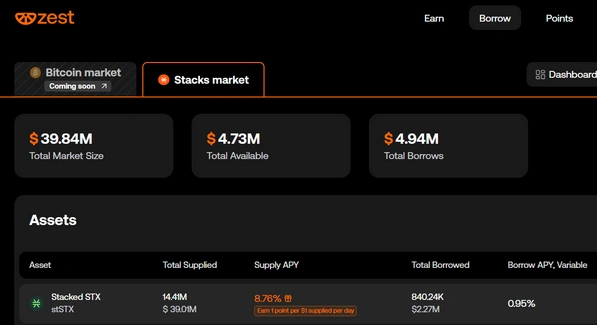

Zest Protocol

Zest Protocol is an open-source Bitcoin-based DeFi protocol designed to facilitate institutional-grade lending and borrowing within the Bitcoin ecosystem. Built on the Bitcoin Lightning Network, Zest enables the creation of permissioned lending pools, connecting bitcoin holders with businesses seeking capital.

Launched to bridge the gap between bitcoin liquidity and institutional borrowers, Zest allows users to deploy bitcoin into lending pools, earning yield while maintaining Bitcoin’s underlying security and decentralization. Borrowers undergo rigorous due diligence to ensure compliance and creditworthiness, creating a reliable environment for lending.

By leveraging the Lightning Network for fast and efficient transactions, Zest Protocol empowers institutions to access Bitcoin-based capital without intermediaries, offering a scalable solution for Bitcoin lending within a decentralized financial infrastructure.

Bottom Line

These six Bitcoin DeFi applications are at the forefront of expanding Bitcoin’s capabilities in 2024. By integrating smart contracts, facilitating instant payments, bridging Bitcoin with broader DeFi ecosystems, and enhancing liquidity and yield generation, they transform Bitcoin from a passive store of value into an active participant in the decentralized financial landscape.

Meet Suhas Harshe, a financial advisor committed to assisting people and businesses in confidently understanding and managing the complexities of the financial world. Suhas has shared his knowledge on various topics like business, investment strategies, optimizing taxes, and promoting financial well-being through articles in InvestmentDose.com